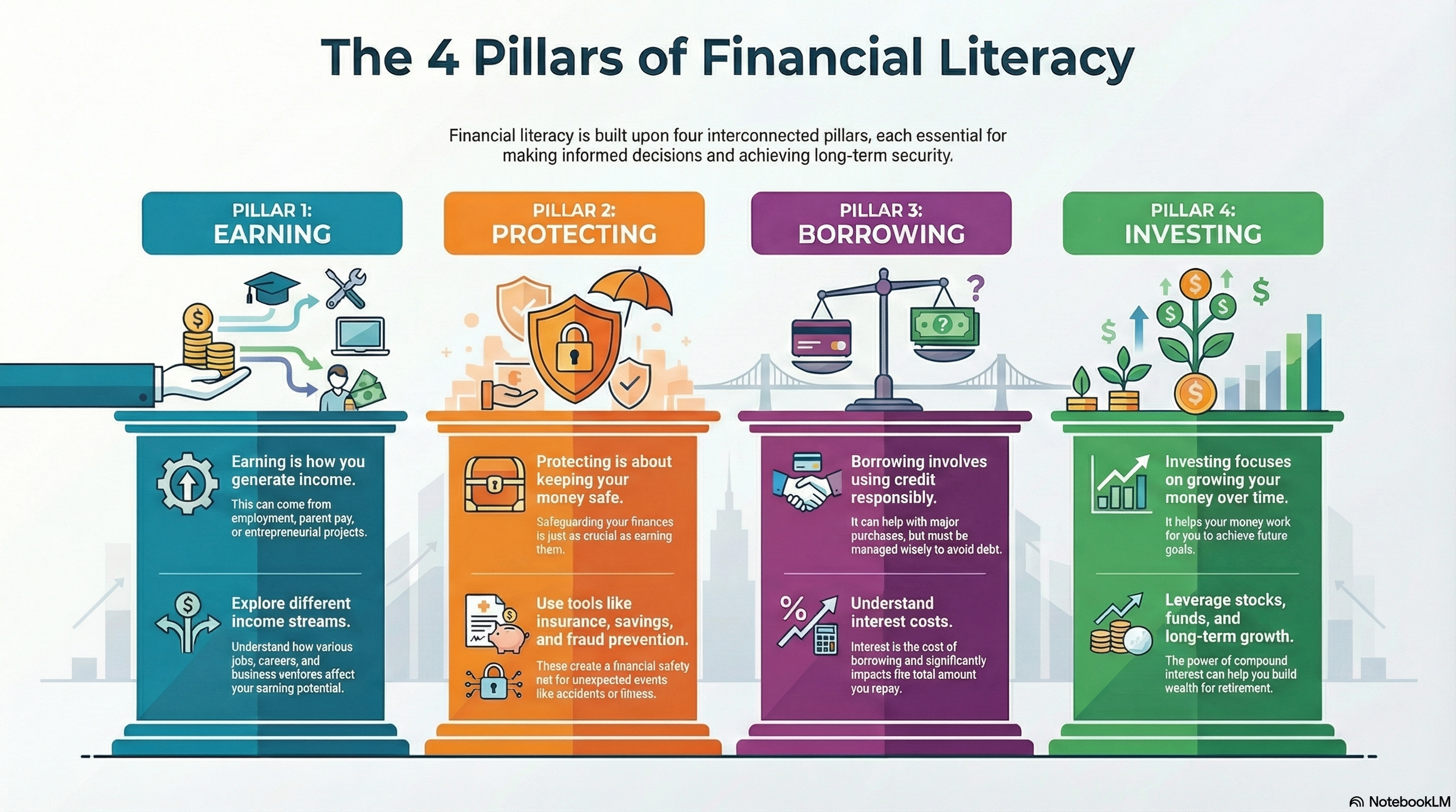

Financial literacy is a vital skill that empowers individuals to make informed decisions about their money. At the foundation of financial literacy lie four essential pillars: Earning, Protecting, Borrowing, and Investing. Each of these pillars plays a crucial role in achieving financial stability and security. In this chapter, we will explore each pillar in-depth and understand how they interconnect to support a balanced financial life.

Earning

The first pillar, Earning, refers to the ways in which you generate income. This can come from various sources, such as employment, allowances from parents, or entrepreneurial ventures. Understanding how to increase your earning potential is fundamental to financial literacy.

Key Concepts:

Income from Work: This is the salary or wages earned from a job. It’s essential to understand how different jobs and careers can offer varying levels of income.

Entrepreneurship: Starting a business can be a rewarding way to earn money, but it also involves risks and requires knowledge about market demands and business management.

Protecting

The second pillar, Protecting, emphasizes the importance of keeping your money safe. This includes understanding insurance, fraud prevention, and the necessity of savings. Protecting your finances is as crucial as earning them.

Key Concepts:

Insurance: Having appropriate insurance coverage helps mitigate risks associated with unforeseen events, such as accidents or illnesses, which could lead to significant financial losses.

Fraud Prevention: Being aware of scams and how to protect personal information is essential to safeguard your finances.

Savings: Building an emergency fund is a key component of financial protection, ensuring you have resources available in times of need.

Borrowing

The third pillar, Borrowing, deals with the responsible use of credit. This includes understanding loans, interest rates, and repayment plans. Borrowing can help you make significant purchases or investments, but it must be done wisely to avoid debt traps.

Key Concepts:

Using Credit Responsibly: It's essential to use borrowed money for productive purposes and not exceed what you can afford to repay.

Interest: Understanding how interest works is crucial when borrowing money; it’s the cost of taking on debt and can significantly affect your total repayment amount.

Investing

The fourth pillar, Investing, focuses on how to grow your money over time. Investing can involve putting your money into stocks, bonds, retirement accounts, or other financial vehicles with the expectation of future growth.

Key Concepts:

Stocks and Funds: Learning about where to invest can help you maximize returns while managing risks.

Long-term Growth: Understanding the power of compound interest can motivate you to invest early and consistently for retirement or other long-term goals

Activity: Build the Pillars: Create a chart with four columns labeled Earning, Protecting, Borrowing, and Investing.

Under the Earning column, list one method you currently use to earn money and one method you’d like to explore.

In the Protecting column of your chart, note one protective measure you currently take with your finances and another you’d like to learn about.

Under the Borrowing column of your chart, jot down one way you currently use credit responsibly and one aspect of borrowing you wish to learn more about.

Finally, in the Investing column of your chart, write down an investment strategy you’re currently using and one new investing concept you’d like to understand better.

Conclusion

The Four Pillars of Financial Literacy—Earning, Protecting, Borrowing, and Investing—are interconnected. If one pillar is weak, the others cannot support a stable financial life. By actively engaging with these concepts and participating in the provided activities, you can build a solid foundation for your financial future.